Signal and strategy

Before describing the strategy backtesting, let’s describe the difference between the strategy and the signal. In our system the signal can take two states, a buy and a sell. Strategy is using signals and is managing the cash assigned to it in a given period. One of the well known strategy is Buy and hold, that is the strategy that buys at the beginning of the period and sells at the end of the period (so why is it called buy and hold?). One of the employed strategies in the mobile version is Long only. The entire cash balance assigned to the strategy is used to purchase shares of stock (or currency, or commodity or forex) at the prevailing market price at the first occurrence of the buy signal. Once bought, the cash balance turns to 0 and stock balance is filled. All subsequent buy signals are ignored until first sell signal occurs, at that time all shares are sold – and cash is credited with the result. As time goes by, the strategy is waiting for the next buy signal and is using available cash (increased with profits or decreased with losses) to purchase shares.

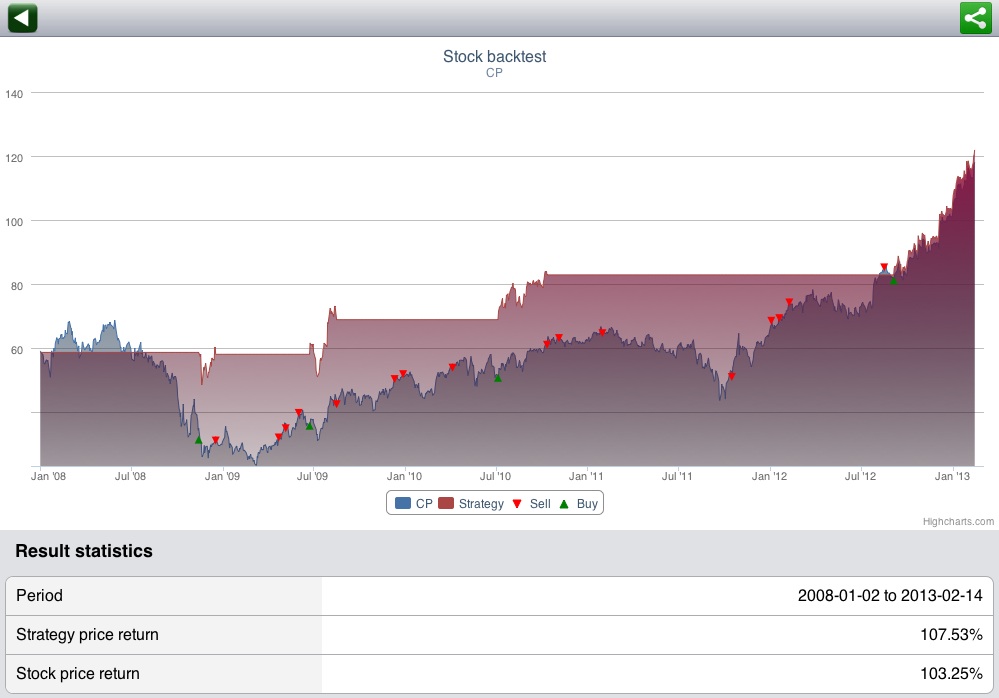

Bellow an example of Long only strategy using Asymmetric signal on CP. In the mobile app – a given strategy is compared to buy and hold. Bellow the equity chart – there are statistics of the strategy/signal track describing the performance of the strategy. We can notice that after the position is sold all subsequent sell signals are ignored – as indicated in unleveraged Long only strategy. Flat line indicates that the strategy has no market exposure – and has achieved the same return in the period as the buy and hold while having spent less then 12 months exposed to market compared to buy and hold which is a bit more than 5 years.